Top Advice For Choosing Gold Items In Stock In Brno

Wiki Article

What Should I Think About When Purchasing Gold Bullion Or Coins From The Czech Republic?

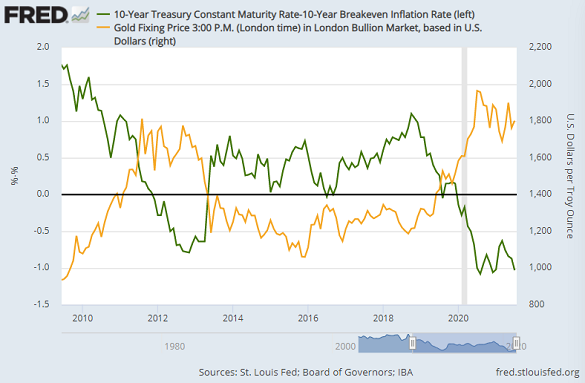

Be aware of the tax implications with buying and/or selling gold in Czech Republic. The investment in gold could result in different tax laws, which could impact your returns. Market Conditions: Be aware on the price of gold as well as market movements. This data can help you decide which time to invest.

Authenticity: Make sure you examine the certificate of any gold coins or bullion before purchasing.

Goals of Investment - Determine your investment goals. It is important to decide if you'd like to invest in gold as a longer-term investment, for portfolio diversification or to protect against inflation.

Consultation and research- Ask for advice from financial advisors, or experts in investing in precious metals. Conduct thorough research and educate yourself on the gold market in order to make informed investment decision.

Keep in mind that although gold can be an excellent investment but it is essential to approach all investments such as precious metals with careful consideration, research and a clear knowledge of your financial goals and risk tolerance. See the recommended buy wiener philharmoniker gold coins in Prague info for site examples including gld shares, price for one ounce of gold, one ounce of gold, 1 oz gold buffalo coin, platinum coins, gold mining stocks, angel coin, gold quarter dollar, good gold stocks, gold eagle and more.

How Do I Ensure The Quality Of The Gold I Buy Has The Proper Documents And Authentic Certifications?

Follow these steps if want to be certain that the gold that you buy is genuine and comes with all of the required documentation.

Verify the authenticity of your certificate by asking for verification options. Certain certificates include verification codes, also known as numeric numbers, that can be verified on the internet or over the phone. Ask about these options and use them to cross-verify. Get advice from experts of third party - Think about consulting appraisers who are independent and experts. They can verify the authenticity of documents as well as gold objects by looking them up.

Compare to Standards Known- Check the documents provided against industry standards or samples of certificates issued by reliable sources. This will help you detect any issues or inconsistencies.

Gold that is trusted sellers - Buy gold from established and trusted dealers or authorized sellers known for their honesty and commitment to industry standards.

Keep receipts, certificates, and any other documents. These will serve as document of purchase, and can be used in the future.

Through actively looking for and scrutinizing provided documentation by comparing them to industry standards and consulting with experts when necessary you can be certain that the gold you buy comes with the proper authentic certifications. Take a look at the recommended top article on buy panda gold coins in Brno for site examples including gdx stocks, five dollar gold coin, 1 10 oz gold eagle, buying silver, st gaudens double eagle, 1 0z gold, gold 1 dollar coin, best gold ira, gold mining stocks, american gold eagle and more.

What's The Main Difference Between A Lower Spread On Gold And A Low Markup On Price Of Stocks?

Low mark-ups and spreads are described as the price of purchasing or selling gold compared to the current market value. These terms define how much you'll pay for the gold, whether in the form of an increase or spread. Low Mark-up - A dealer will charge a minimal fee or charge that is higher than the current market price for gold. A low markup happens when the price you're paid for purchasing gold is only slightly or barely more than the current value of gold.

Low Price Spread The spread can be defined as the difference in gold's buying (bid) price and the selling (ask). A spread with a low price indicates a narrow gap between these prices meaning there's less an in-between between the price at which you are able to purchase gold and the price that you can sell it.

What Is The Markup And Price Difference Among Gold Dealers?

Negotiability. Certain dealers are more flexible when it comes to negotiating markups or spreads. This is particularly relevant for repeat customers or more substantial transactions. Geographical location: Spreads, mark-ups, and local regulations can all depend on the regional context. Dealers located in areas that have excessive taxes or regulatory costs could pass these costs to customers in the form of higher markups.

Types of Products and Availability: Markups and spreads can differ based on the type of product (coins/bars/collectibles) and the availability of the item. Because of their rarity, rare and collectibles can command higher markups.

Market Conditions- When there is a huge demand for a product, or a lack of or volatility in the market, dealers will increase their spreads as a way to reduce risk or cover losses.

It is essential for investors, based on these elements, to do extensive research examine prices, compare prices and look at other factors like reputation, trustworthiness and customer service when choosing a seller. A quick search and comparison of quotes from various sources can help identify the most competitive prices for buying gold. Have a look at the best buy argor heraeus in Czech Republic for website recommendations including purchase gold bullion, kruger rand, gold buffalo coin, gold one dollar coin, $5 gold coin, ancient coin, 20 dollar coin, one oz of gold, gold silver coins, gold silver coins and more.